.jpg)

A few weeks ago I posted about how we set up our budget. This week I’m going to share how I keep track of everything once it has been budgeted!

Software like Quicken & Mint are GREAT if your brain can handle a whole month of lots of categories at a time. Turns out I can’t. I can’t say I have $150 to spend on dining per month, and maybe $50 on clothes for the whole month. It never worked. I was NEVER in my budget and it was completely frustrating. Some months I spent $200 on dining, and $0 on clothes and I felt that these software choices didn’t account for that. Plus, I just had WAY to many categories and it drove me crazy.

It was also difficult and complicated even with the mobile app. It just never happened in the moment that I spent my money.

After a frustrating few years of tracking all of our expenses in Quicken, and then Mint and not being able to stay under in any of my budget categories, I discovered Toshl. For some reason, this way of budgeting just clicked with my brain and I’ve been doing pretty good at staying withing our set budgets ever since.

Toshl is flexible enough that I can have my “discretionary” category, and its hard to let items just slip through the cracks. You can also track cash really easily (all our laundry is paid with quarters) something Quicken & Mint were never good at.

To set up more than one budget, you do need the Premium Version. It’s totally worth the $19.99 annual fee to be able to set up multiple budgets.

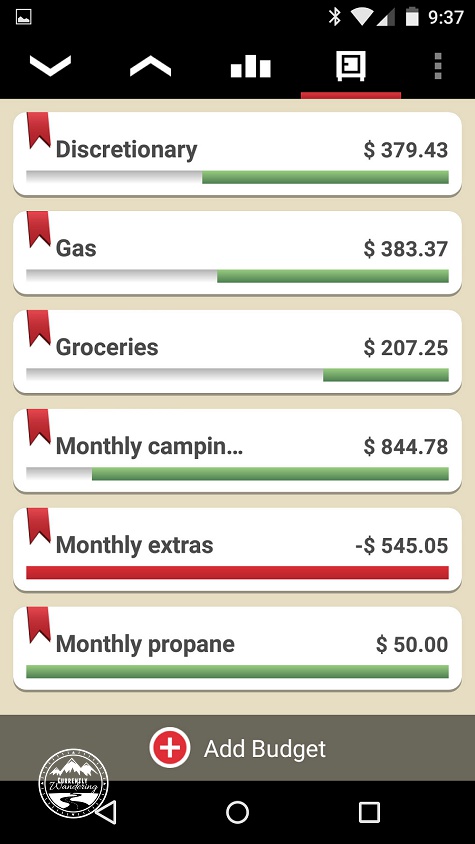

If you’ve read my previous financial post on determine our budget amounts, you’ll notice that my variable spending categories are also my budgets in Toshl: Discretionary, gas, camping fees, groceries & propane.

Here’s a view of an individual budget. My favorite part is that black dotted line. It helps me know where I am in relation to the rest of the month. Have I totally overspent? Do I have a lot of money left over? For my discretionary budget in this case I’m pretty close – gas we are a little bit over so far in the month. This helps me know that I need to cut back, or if we have a little extra money to splurge going out to ice cream!

.jpg)

It’s super easy to add expenses as they occur, especially those pesky cash expenses that I can never remember later. I have a widget on my home screen that I just tap, enter in the information, tap the check mark and its done!

.jpg)

You can view expenses in a list either by date or by category which is super helpful when I sit down with Mint twice a month and double check that everything has made it in to Toshl (yes, I still use Mint.com for overall tracking as its super helpful come tax season!).

.jpg)

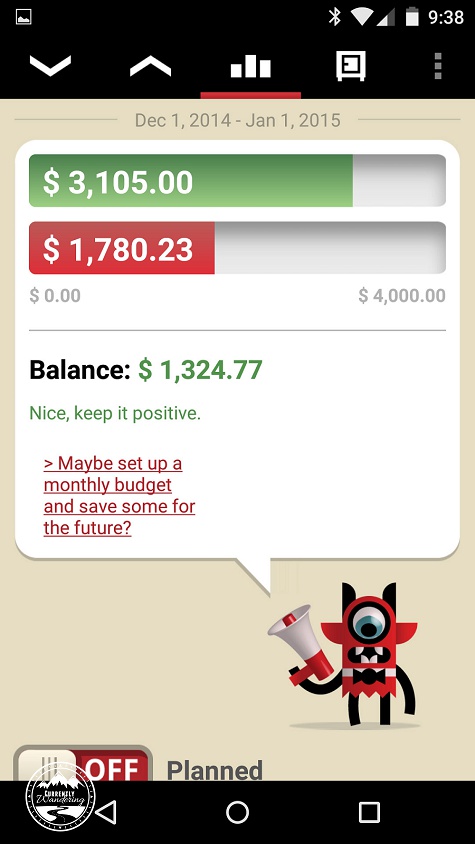

I’ve also set our amount for variable spending (paycheck – fixed expenses) under “income” so I can keep track if we are under or over across the board. Sometimes we go way over on groceries (like last month!) but we are way under on gas and groceries. I figure as long as my balance is positive I’m doing pretty good for the month!

Excited yet? I seriously love this app, and no, we weren’t paid to write this article. 🙂 I hope this helped give you a brief overview of how I work and keep track of our budget. If you want to just give it a try, sign up for free and test out tracking one budget category and see how it goes!

Excited yet? I seriously love this app, and no, we weren’t paid to write this article. 🙂 I hope this helped give you a brief overview of how I work and keep track of our budget. If you want to just give it a try, sign up for free and test out tracking one budget category and see how it goes!

Having control over our finances and really understand where our money was going has helped increase our confidence that we can make this lifestyle work for us!

What about you? Any financial tools you’ve found to be super useful?

Image Credit: 401kcalculator.org

What a cool piece of technology! This looks like it would make budgeting so much easier!